The 5 KPIs Every Business Needs To Know

Divyansh Shekhawat

Published: August 6, 2025

Tracking Key Performance Indicators (KPIs) enables businesses to make data-driven decisions, uncover growth opportunities, and address inefficiencies. While every business might prioritize slightly different metrics, here are five universally critical KPIs that provide a well-rounded view of performance.

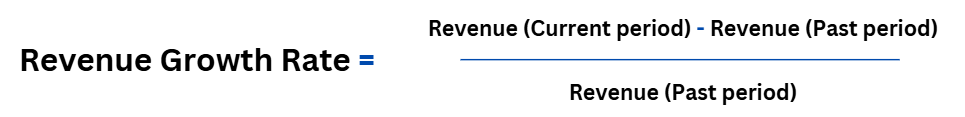

1. Revenue Growth Rate

Why It Matters: Revenue Growth Rate is a direct indicator of your company’s financial trajectory. It shows whether your business is successfully scaling and resonating with your target market.

What It Indicates:

Positive growth suggests strong product-market fit and effective strategies.

Negative growth highlights the need for better marketing, pricing, or product adjustments.

Pro Tip: Segment revenue by region or product category for a deeper understanding of growth drivers.

How to Calculate:

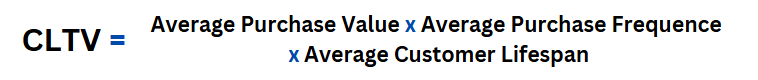

2. Customer Lifetime Value (CLTV)

Why It Matters: CLTV measures the total revenue a business can expect from a customer over the duration of their relationship. It helps in assessing the value of customer retention and optimizing acquisition strategies.

What It Indicates:

A high CLTV relative to acquisition costs (C

AC) indicates a sustainable business model.

A low CLTV signals potential customer churn or underwhelming engagement.

Pro Tip: Invest in customer retention strategies like loyalty programs to maximize CLTV.

How to Calculate:

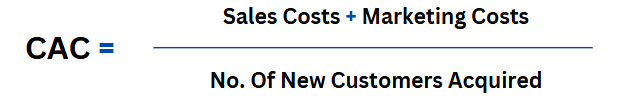

3. Customer Acquisition Cost (CAC)

Why It Matters: CAC is the cost associated with gaining a new customer. Monitoring this ensures that your marketing and sales efforts are cost-effective and sustainable.

What It Indicates:

Low CAC relative to CLTV shows efficient customer acquisition.

High CAC may indicate weak targeting or inefficient marketing spend.

Pro Tip: Optimize campaigns by leveraging customer data to target high-value segments.

How to Calculate:

Looking to 3x Your Revenue?

Check out our 3 Insight Levels To 3x Revenue Program By Clicking Below

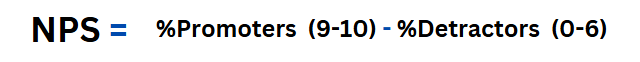

4. Net Promoter Score (NPS)

Why It Matters: NPS reflects customer satisfaction and loyalty, which are critical for driving repeat business and organic growth through referrals.

What It Indicates:

High NPS shows strong customer satisfaction and advocacy.

Low NPS points to issues in service quality or product fit.

Pro Tip: Pair NPS with qualitative feedback to identify areas for improvement.

How to Calculate:

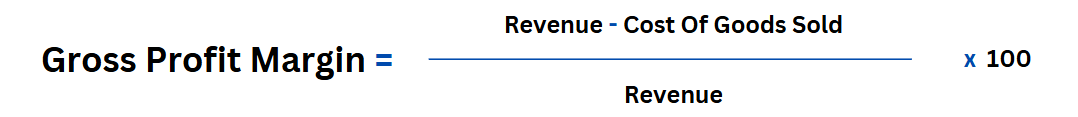

5. Gross Profit Margin

Why It Matters: Gross Profit Margin indicates how efficiently a business is producing and delivering its goods or services relative to costs. It directly impacts profitability and sustainability.

What It Indicates:

High margins suggest efficient cost control and pricing strategies.

Low margins signal rising costs or pricing inefficiencies.

Pro Tip: Regularly review suppliers, production processes, and pricing to maintain healthy margins.

How to Calculate:

Wrapping It Up

By closely monitoring thesefive KPIs—Revenue Growth Rate, CLTV, CAC, NPS, and Gross Profit Margin—you can gain invaluable insights into your business’s performance, profitability, and growth potential. Each metric provides a unique lens, helping you make strategic adjustments that lead to sustainable success.

At DivIntelligence, we specialize in helping businesses decode these KPIs and align them with actionable strategies. Are you ready to unlock the full potential of your data? Reach out today!

Looking To Get Started with a project/program?

To get started simply click the button below or contact us to ask any questions – We look forward to speaking with you